Understanding Comparative Statements: Sorts, Advantages, And Limitations

It educated its workers to decrease labor costs and procured uncooked materials at a cheaper worth. Notice complete current belongings have elevated $ 14.3 million, consisting largely of increases in money, marketable securities, and other present belongings despite a $63.zero million lower in internet receivables. Notice total current belongings have elevated $ 14.3 million, consisting largely of increases in money, marketable securities, and other current property despite a $63.0 million decrease in net receivables. Assume, for example, that a manufacturer’s cost of products sold (COGS) increases from 30% of sales to 45% of gross sales over three years.

۱: Analyzing Comparative Monetary Statements

Comparative monetary statements may be misleading if they include non-recurring items similar to one-time gains or losses. These items can significantly influence a company’s monetary well being and make it troublesome to match monetary statements between intervals. For instance, if an organization sold a subsidiary in one period, the monetary statements for that interval would not be comparable to other intervals. To keep away from this mistake, it is essential to exclude non-recurring items when creating comparative monetary statements. One Other frequent mistake is using inaccurate data when creating comparative financial statements. This can happen when there are errors within the financial data or when there are discrepancies between the data sources used.

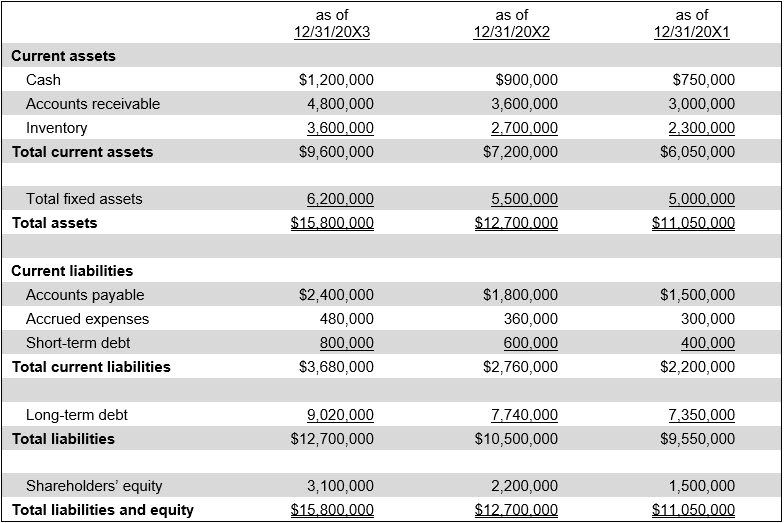

A comparative statement is a monetary assertion that helps compare components of a business’s income assertion and stability sheet over a duration of at least two intervals, in share and absolute kind. It presents previous figures with the latest financials, enabling one to compare a company’s performance in opposition to its competitors. The key benefit of a comparative stability sheet is that it gives you the ability to identify developments in the presented knowledge.

- By delving into the world of economic ratios interpretation, you’ll gain a clearer understanding of your company’s strengths and weaknesses, allowing you to determine particular areas for enchancment.

- These gadgets can significantly influence an organization’s monetary health and make it tough to check financial statements between periods.

- Study your company’s stability sheets to achieve priceless insights into your monetary performance over time.

- Meanwhile, managerial accounting practices also depend on sound adjustments to assist internal decision-making, efficiency evaluations, and budgeting processes.

Comparative monetary statements may additionally be used to make knowledgeable choices a few business. By analyzing financial data from totally different intervals, it’s potential to establish areas where a company is performing properly and areas the place it’s struggling. This may help enterprise house owners and managers make knowledgeable selections about where to allocate resources and tips on how to improve the company’s financial efficiency. To ensure that comparative monetary statements present accurate and useful info, it is important to observe best practices.

Comparative financial statements are prepared by taking the monetary data from the previous interval and comparing it to the present period. The comparisons gain real that means from such ratios — gross profit margin, web profit margin, return on assets, debt ratio. It is important to compare these ratios with trade benchmarks or earlier years’ information to get a clearer image of the company’s performance relative to its competitors or itself. Such a monetary assertion is predicated on the financial information of a minimum of two periods, usually a 12 months. Suppose a financial assertion ready by Panther Tees, an internet t-shirt retailer, reveals the company’s income and bills recorded in FY2021 and FY2022.

Cash Circulate Statement Evaluation

The comparative statement which means refers to a financial statement that helps one compare a enterprise’s monetary performance in a single interval towards that of another interval. It lets one find out about a business’s efficiency results for a number of durations without taking a look at different monetary statements. In different words, it presents financial figures from multiple intervals in a single statement. Often, it consists of economic information of solely two intervals, as too many columns could be troublesome to read for individuals.

This evaluation helps you determine any areas the place enhancements may be made and measure the success of carried out methods. Comparative financial statements provide a comprehensive overview of your company’s efficiency over a number of years, permitting you to research trends and patterns. By comparing information from totally different intervals, you probably can establish areas of development or decline and make informed decisions for the longer term. They include side-by-side comparisons of economic information from completely different accounting periods, sometimes presenting the present period’s figures alongside those from the previous period.

The mostly used financial analysis tools are comparative statements, widespread measurement statements, trend analysis, ratio evaluation, funds circulate analysis and cash flow evaluation. Equally, comparing the stability sheets helps in evaluating the company’s liquidity, solvency, and general monetary well being. The money move statement comparability, however, reveals the sources and makes use of of cash, depicting the organization’s capacity to generate cash and meet its monetary obligations. Comparative financial statements are important for conducting in-depth financial analysis, as they offer a complete view of an entity’s monetary efficiency, place, and condition across totally different time periods. To effectively interpret and make the most of comparative financial statements for decision making, give attention to decoding trends and analyzing adjustments over time. This will allow you to make knowledgeable decisions and have larger management over your decision-making process.

Interpretation Of Ratios And Monetary Indicators

By evaluating your company’s monetary ratios, similar to profitability and liquidity, to those of comparable companies in the same business, you possibly can gauge how nicely your corporation is performing relative to its rivals. This information helps you establish areas the place https://www.simple-accounting.org/ your organization could additionally be underperforming and develop strategies to improve its competitive position. A set of comparative financial statements consists of a number of columns representing different durations, permitting for a side-by-side comparison. Key elements corresponding to revenues, expenses, property, liabilities, and fairness are presented, providing a complete view of the corporate’s financial evolution. Comparative financial statements are monetary reviews that present the monetary knowledge of a company for multiple durations side by side, allowing for straightforward comparison of financial performance and tendencies over time.

Economic circumstances, business developments, and the competitive panorama can significantly impression a company’s financial outcomes. Due To This Fact, it’s essential to take these factors under consideration when evaluating a company’s performance over time. To overcome these challenges and limitations, it is important to have a strong basis in financial concepts and stay updated with modifications in accounting standards.